Bridging the Talent Gap in Semiconductor Construction

Tackling Engineering and Workforce Challenges As the semiconductor industry accelerates global expansion, a new kind of bottleneck threatens its momentum—not...

Top 12 In-Demand Tech Jobs for 2024

The tech industry continues to evolve rapidly, creating new opportunities and demanding specific skill sets. To stay ahead in this...

Top Life Science Careers in 2024: A Comprehensive Guide

The field of life sciences is experiencing rapid growth and innovation, opening up exciting career opportunities for professionals. In this...

Top 10 Renewable Energy Companies Leading the Way Towards a Sustainable Future

Renewable energy is revolutionising the way we power our world. With the increasing demand for sustainable and clean energy sources,...

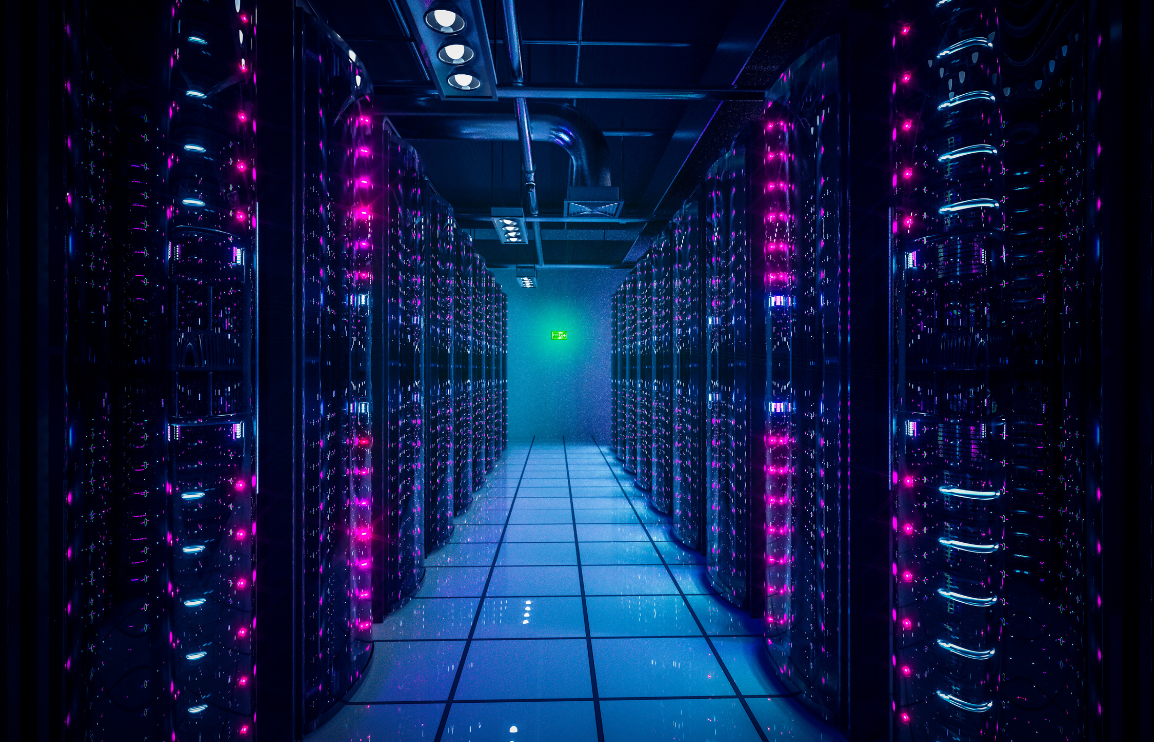

Top 10 Data Centre Businesses Revolutionising the Future of Connectivity

The world of technology is progressing at an unprecedented pace, and with it comes the increasing need for robust data...